Nov . 24, 2024 20:43 Back to list

Understanding Hexagonal Netting and Its Applications in Financial Transactions

Understanding Hexagonal Netting Companies A Comprehensive Overview

In the financial landscape, where transactions are ubiquitous and the need for efficiency is paramount, hexagonal netting companies have emerged as vital players. These companies specialize in optimizing and streamlining complex intercompany transactions, thereby reducing the overall financial burden associated with multiple payments and settlements.

What is Hexagonal Netting?

Hexagonal netting refers to a sophisticated financial process where multiple parties settle their obligations to each other within a structured framework, often visualized in a hexagonal format. This system allows for netting off transactions among several participants, which simplifies the accounting process and minimizes the need for cash transfers.

The beauty of hexagonal netting lies in its efficiency. Traditional payment systems require each party to settle their debts individually, which can lead to high transaction fees, increased time for settlements, and unnecessary complexity. In contrast, hexagonal netting reduces these challenges by consolidating multiple payments into single net amounts, thereby facilitating smoother transactions.

The Role of Hexagonal Netting Companies

Hexagonal netting companies act as intermediaries that manage this intricate process. They develop and maintain platforms and software that calculate net obligations, streamline communications between parties, and ensure compliance with regulatory requirements. By leveraging sophisticated algorithms and data analytics, these companies can offer real-time settlement information, which enhances transparency and trust among the participants.

Benefits of Using Hexagonal Netting

1. Cost Efficiency One of the most significant advantages of hexagonal netting is the reduction in transaction costs. By consolidating payments, companies can save on fees associated with multiple transfers and reduce their operational costs.

2. Reduced Credit Risk By minimizing the number of transactions and focusing on net obligations, hexagonal netting mitigates the exposure of participants to counterparty risks. This is particularly crucial in volatile markets where the financial stability of counter-parties may come into question.

hexagonal netting companies

3. Improved Liquidity Management Hexagonal netting companies provide tools that help organizations better manage their liquidity. By understanding their net positions, businesses can make more informed decisions on cash reserves and investments.

4. Enhanced Regulatory Compliance With increasing regulatory scrutiny on financial transactions, hexagonal netting companies ensure that their platforms adhere to necessary legal frameworks. This compliance not only protects companies from potential fines but also instills confidence among stakeholders.

5. Scalability and Flexibility As businesses grow, their transaction volumes typically increase. Hexagonal netting companies offer scalable solutions that can efficiently handle growing transaction loads without compromising on performance or reliability.

Key Players in Hexagonal Netting

Several companies have carved a niche in the hexagonal netting space, providing cutting-edge solutions. Among them, some of the notable players include

1. Triangular Networks Known for their innovative digital platforms, Triangular Networks offers robust solutions tailored to businesses looking to streamline their intercompany settlements.

2. Netting Corp Specializing in providing comprehensive netting services, Netting Corp has a reputation for reliability and efficiency, making it a preferred choice among multinational corporations.

3. Settlemint With a focus on integrating blockchain technology in their netting solutions, Settlemint is leading the charge in modernizing traditional financial practices, providing enhanced security and transparency.

Conclusion

Hexagonal netting companies play a crucial role in the modern financial ecosystem. By providing efficient solutions for managing complex intercompany transactions, they not only save costs but also reduce risks and ensure compliance with regulations. As businesses continue to seek ways to enhance efficiency and optimize cash flow, the significance of hexagonal netting will only grow, marking these companies as essential partners in the financial landscape. As we move further into a technology-driven future, the adaptability and innovation of hexagonal netting companies will define their success in meeting the evolving needs of global commerce.

-

High Quality 9 Gauge Expanded Metal Mesh & Chain Link Wire Mesh Fence Manufacturer

NewsJun.10,2025

-

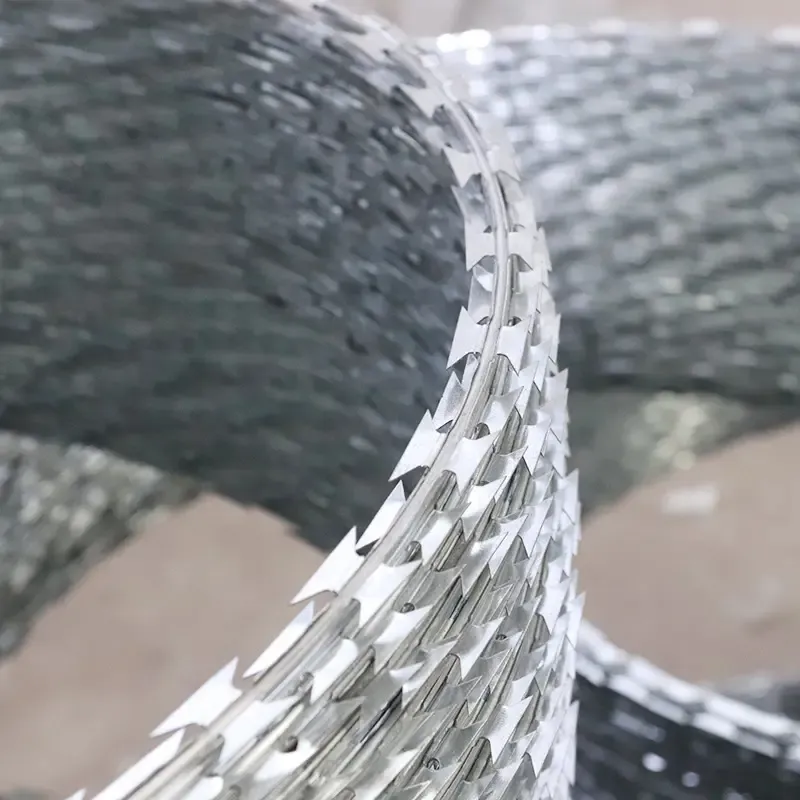

Barbed Wire Roll Price - Wholesale Exporters & Reliable Factories Supply

NewsJun.10,2025

-

High-Quality Temporary Mesh Fence Panels for Sale Durable Temporary Fence Panels Supplier

NewsJun.10,2025

-

Welded Wire Fence Mesh Exporters Custom Sizes & Competitive Pricing

NewsJun.10,2025

-

Durable China Expanded Metal Security Mesh High-Security & Affordable

NewsJun.10,2025

-

White Expanded Metal Mesh Durable for Temp Fencing & Plaster

NewsJun.10,2025